First Look at July 2023 Housing Inventory. Texas is in trouble.

By Nick Gerli | Posted on July 28, 2023I just finished putting together preliminary housing inventory figures for July 2023 and the results leave me thinking one thing:

Texas is in trouble.

Why?

Because Texas' Housing Market is getting hit by a double-barreled blast of both Sale and Rental inventory sitting on the market this summer. Meanwhile, the levels of buyer competition across the state are the lowest in America. Signals that both home prices and rents in Texas could be on a downward trajectory for the rest of 2023.

Skyrocketing Inventory Levels in Texas

In just a moment, I will cover some other states (California, in particular) regarding their inventory trends in July. But first let's examine Texas a bit deeper to see what homebuyers and investors need to pay attention to there.

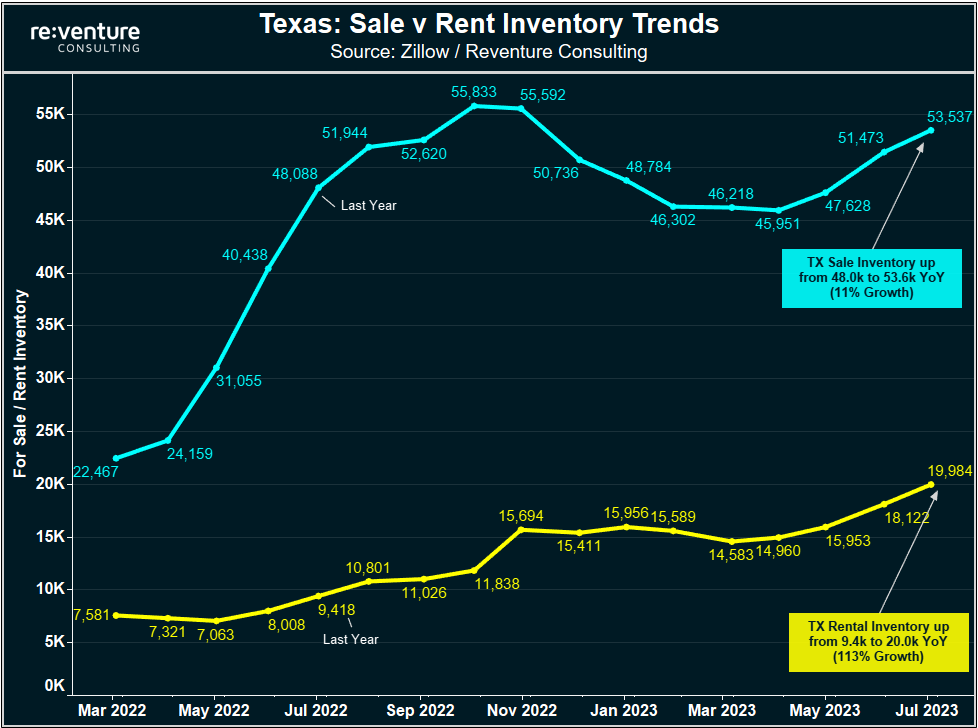

In the graph below, the blue line measures the For Sale Inventory for houses and townhouses in Texas going back to March 2022. What immediately stands out is the massive inventory spike that occurred last summer, which is what drove prices down in Texas last winter.

Now - those inventory levels began to fall in the beginning of 2023 as a shortage of new listings and a brief surge in buyer demand took homes off the market. However, that's now over, and inventory is climbing once again, up to 53.6k houses across Texas in the large counties I track.

That's up 11% from the elevated level of last year and will likely continue to increase in future months given the big drop in buyers that Texas is now experiencing.

Moreover - the rental market in Texas continues to soften, with total rental inventory (only houses and townhouses, no apartments) up to 20.0k in July 2023, a massive 113% spike from last year.

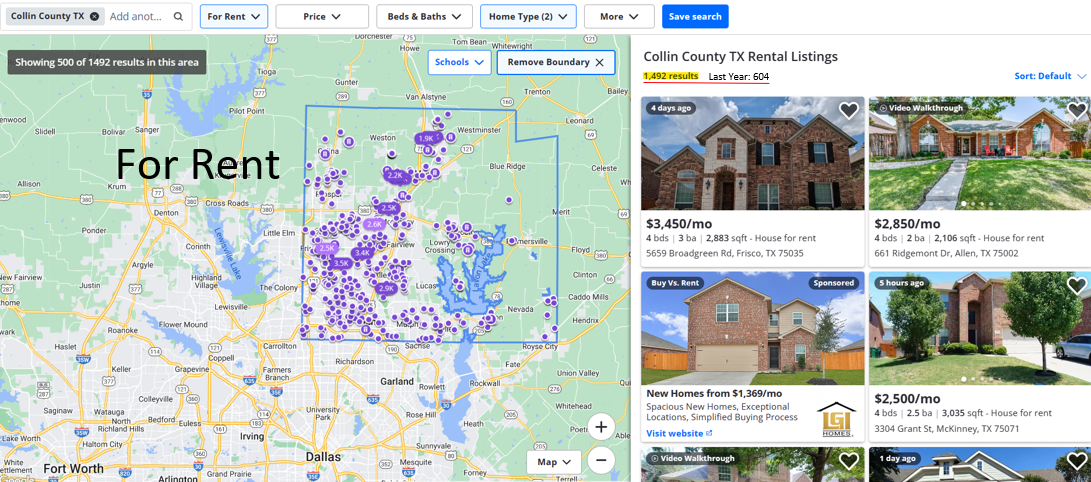

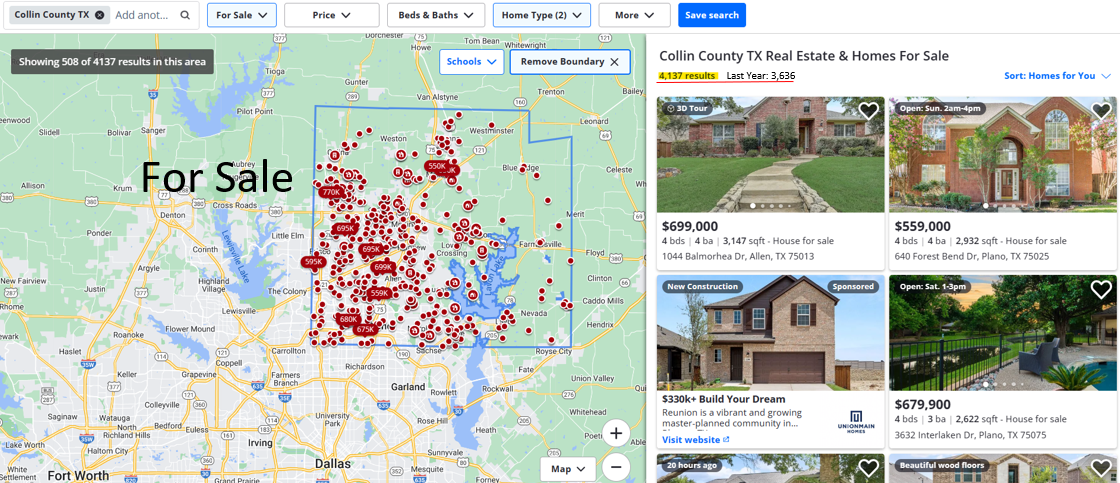

One area of Texas that is seeing this double-barreled inventory spike most intensely is Collin County, directly north of Dallas. Where the rental inventory has increased from 604 to 1,492 YoY (+147%) and the sale inventory has gone up from 3,636 to 4,137 (+14%).

I've heard complaints from both buyers and renters in Collin County, and other parts of Texas, that it's still hard to find a nice place at a reasonable price. However, if this double-barreled inventory pile-up continues, further price relief will come.

Low Levels of Homebuyer Competition in Texas

But looking at inventory levels only really tells one side of the story: the supply side. To do a proper assessment of the future direction of the Texas Housing Market, or any other Housing Market for that matter, we need to consider the demand side as well.

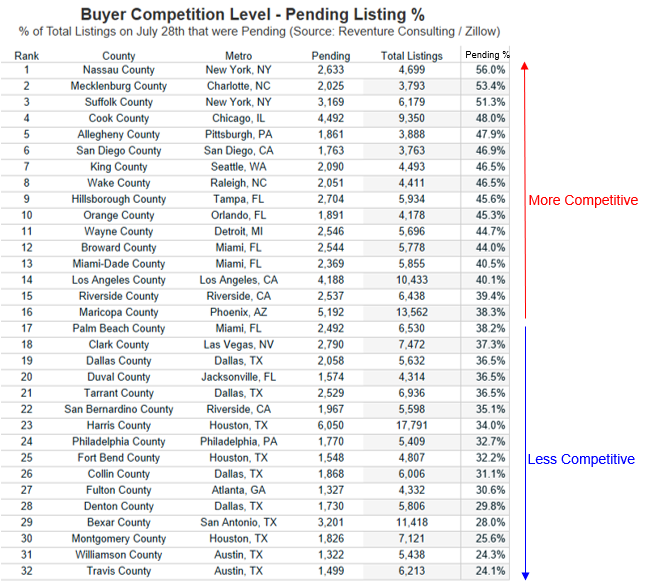

And the issue in Texas right now is that as supply is increasing, buyer demand is declining. A reality you can get a sense of on the table below, which tracks homebuyer competition in large counties across America. With the competition level being measured by the % of total listings on the market that are currently pending (on July 28th).

The highest buyer competition in America is coming on Long Island in Nassau County, NY, where 56% of the total listings on the market are currently pending. Other markets with high competition including Charlotte, Chicago, Pittsburgh, and San Diego.

All the way on the bottom of this list is a raft of Texas cities, like Austin, San Antonio, Houston, and Dallas, where less than 30% of the total listings are currently pending. A signal that there are fewer people in Texas looking to buy a house right now.

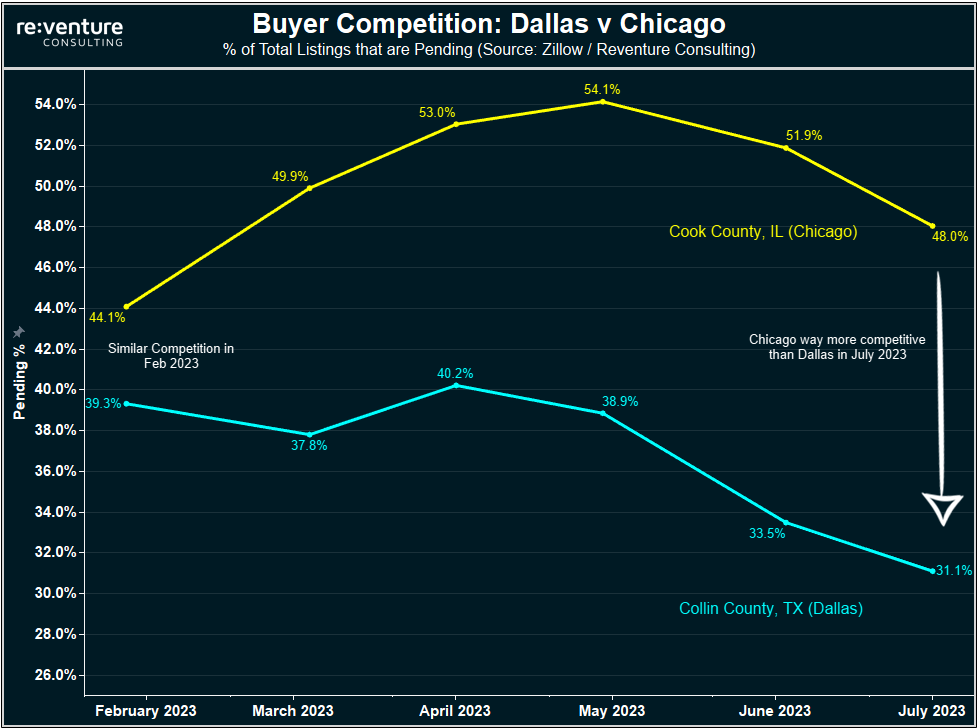

To understand these differences in Buyer Competition more clearly, let's compare Dallas (represented by Collin County) to Chicago (Cook County) over the last five months. You can see that back in February 2023 both markets had a similar level of buyer competition, represented by the share of total listings going pending.

But that is no longer the case. Fast forward to July and Chicago has become one of the most competitive housing markets in America, with 48% of listings currently pending. Meanwhile, in Collin County the pending share is only 31% and declining rapidly.

Which underscores the point: Texas' housing market is struggling right now. Something that might be difficult to comprehend if you were a buyer looking in the spring. But the market has shifted in a big way since then, on both the sale and rental side.

What the heck is going on in California?

Home prices and rents seem likely to decline in Texas over the next several months, however, they do not appear as likely to do that in California.

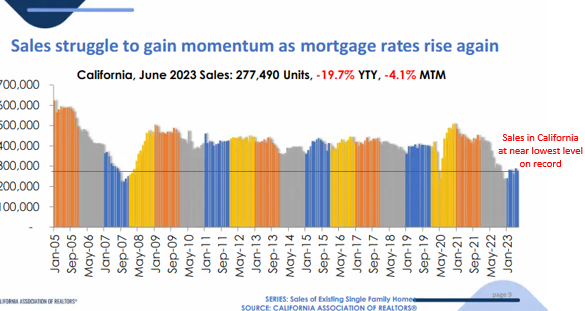

Where a very bizarre situation is forming with homebuyer demand sitting near the lowest level on record according to the California Association of Realtors.

However, it doesn't feel this way for California homebuyers right now. Because a historic collapse in listings is suppressing inventory and creating the perception of strong buyer demand.

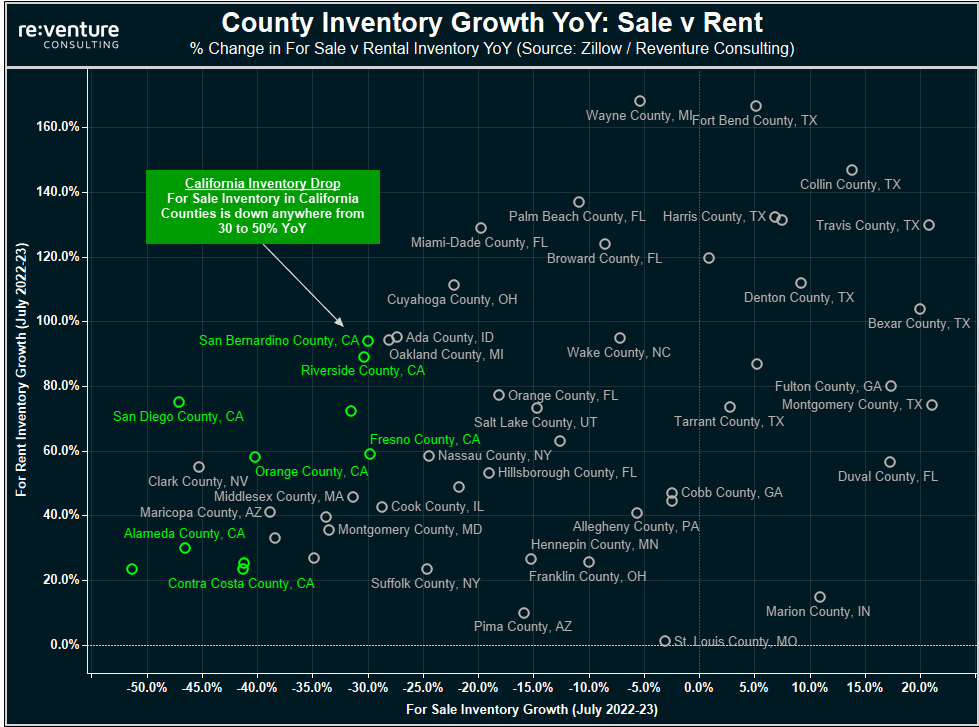

You can see this evidenced on the graph below, which plots the change in Sale v Rental Inventory in the 54 large counties across America I track in this preliminary inventory data each month. And what jumps out is how all the California counties are towards the bottom left of the graph.

They've all experienced anywhere from a 30 to 50% drop in Sale Inventory over the last year, a depressing statistic for homebuyers in California.

The silver lining is that rental inventory has increased significantly in areas like San Bernardino, Riverside, and San Diego. Perhaps some would-be sellers are deciding to rent their house instead of sell it. And while that is a trend that could push rents down into the future, which will eventually filter into lower prices, that reality is probably of little consolation to a would-be buyer in California right now.

And the main issue I see in California's Housing Market right now, from a homebuyer perspective, is that there is a complete lack of distress among sellers. Despite all the tech layoffs over the last year, and a rising unemployment rate in the state, sellers do not appear to have any distress motivating them to sell right now.

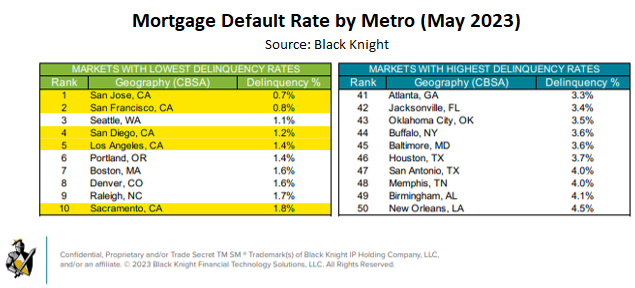

You can see this evidenced through the extremely low mortgage default rates present across California, with Black Knight reporting that California metros have the lowest mortgage default rates in America.

4 of the top 5 lowest default rates are in California, and 5 of the top 10. In the Bay Area the default rate is less than 1%. In Sacramento it's less than 2%. Which is not what I expected to see a full year into a tech recession that resulted in widespread layoffs across the state.

Meanwhile, you can see that mortgage default rates are highest across states like Georgia, Florida, and Texas, which is where we're seeing the most new listing and inventory build-up.

What will happen in California's Housing Market in the second half of 2023?

According to Black Knight, mortgage default rates on the West Coast are running "as much as 69% below their long run averages". Which is a wild statistic when you really think about it. And one that doesn't seem sustainable to me.

I suspect all the free money handed out during the pandemic, and even more free money handed out at the end of 2022 by Gavin Newsom, has artificially suppressed mortgage defaults and homeowner distress in California. Which is constraining new listings and inventory on the market.

At the same time, today's 4.6% unemployment rate in California, which is up slightly from its lows last year, is still near the lowest level on record. Indicating that jobs are still fairly plentiful and easy to find the in the Golden State, another factor suppressing listings and homeowner distress.

But be forewarned - the unemployment rate in California has hit 10% in 4 out of the last 5 recessions going back to the early 1980s. This is a state that tends to get crushed in economic downturns, which is one of the reasons that it has been prone to experiencing housing crashes historically.

It's a matter of "when", not "if", California's economy will head south and result in widespread homeowner distress, increases in inventory, and lower prices. But unfortunately, it's difficult to predict timing of that, with the local economy proving more resilient than expected in 2022 and 2023.

Don't be surprised if both inventory and homebuyer demand remain near rock-bottom levels in California for the next several. Leaving home prices to trade sideways in the near-term.

Where does this data come from?

The Sale and Rental Inventory data presented in this post comes from my preliminary monthly inventory calculations for 54 large US Counties that I catalog manually from Zillow (for houses and townhouses only, no condos).

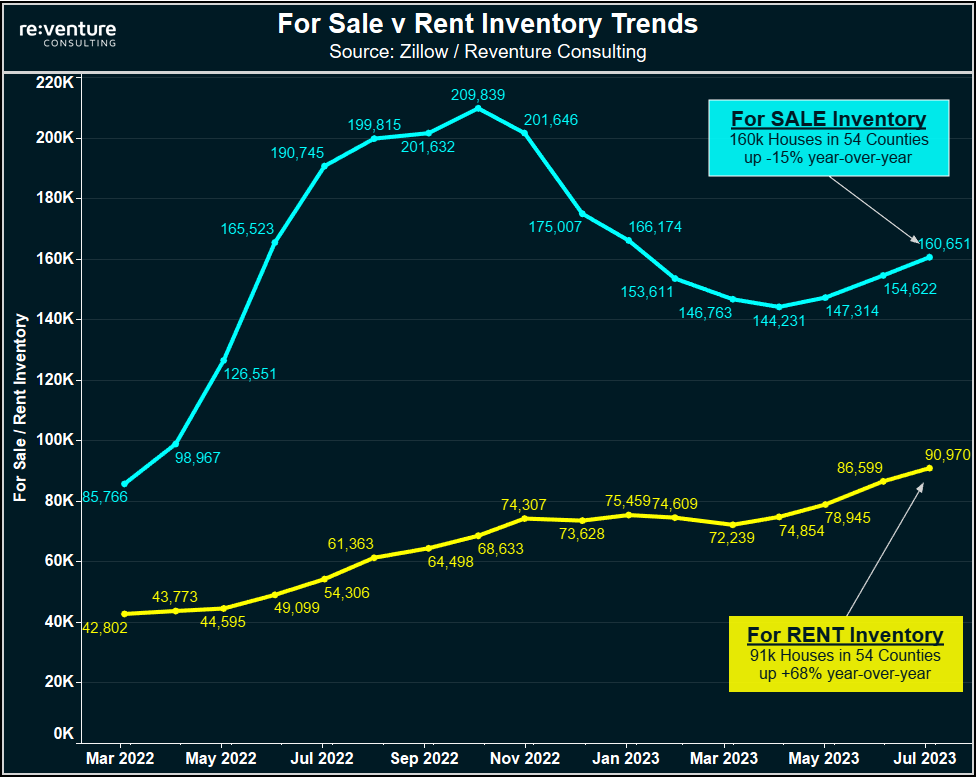

On a national level, Sale Inventory increased again in July, marking the third consecutive month of increases. Which is good news for buyers. However, the sale inventory levels this month was -15% below the same time last year, which is not good news for buyers. Don't be surprised if we continue to see seasonal gains in Sale Inventory in coming months, but for the YoY comparisons to remain negative.

Meanwhile, rental inventory on a national basis continues to rocket higher, now up a massive 68% from where it was last year. I expect vacant rentals to continue hitting the market over the next several months as the summer leasing season comes to a close.

Ultimately the surge in rental house inventory, to go along with a massive pipeline of apartment construction, suggests that rental rates in America will continue their downward trend in the second half of 2023.

"Official" July 2023 Inventory Data release on Reventure App late next week

The "official" inventory data on Reventure App is sourced from Realtor.com, and will be available to view at the end of next week (likely by August 5th) for every State, County, and ZIP Code in America. Data on Seller Price Cuts and Days on the Market will also be updated.

Stay tuned.

-Nick